- About

- Research

-

-

- Special Reports & Features

- The Rematriation of Indigenous Place Names

- Braiding Accountability: A Ten-Year Review of the TRC’s Healthcare Calls to Action

- Buried Burdens: The True Costs of Liquified Natural Gas (LNG) Ownership

- Pretendians and Publications: The Problem and Solutions to Redface Research

- Pinasunniq: Reflections on a Northern Indigenous Economy

- From Risk to Resilience: Indigenous Alternatives to Climate Risk Assessment in Canada

- Twenty-Five Years of Gladue: Indigenous ‘Over-Incarceration’ & the Failure of the Criminal Justice System on the Grand River

- Calls to Action Accountability: A 2023 Status Update on Reconciliation

- View all reports.

- Special Reports & Features

-

-

- Yellowhead School

-

- The Treaty Map

- LIBRARY

- Submissions

- Donate

Emerging from an explosion of resource development in the 1990s and corresponding conflicts in the courts, Indigenous people have pushed for the development of minimum legal standards such as the Duty to Consult and Accommodate to protect their lands and resources.

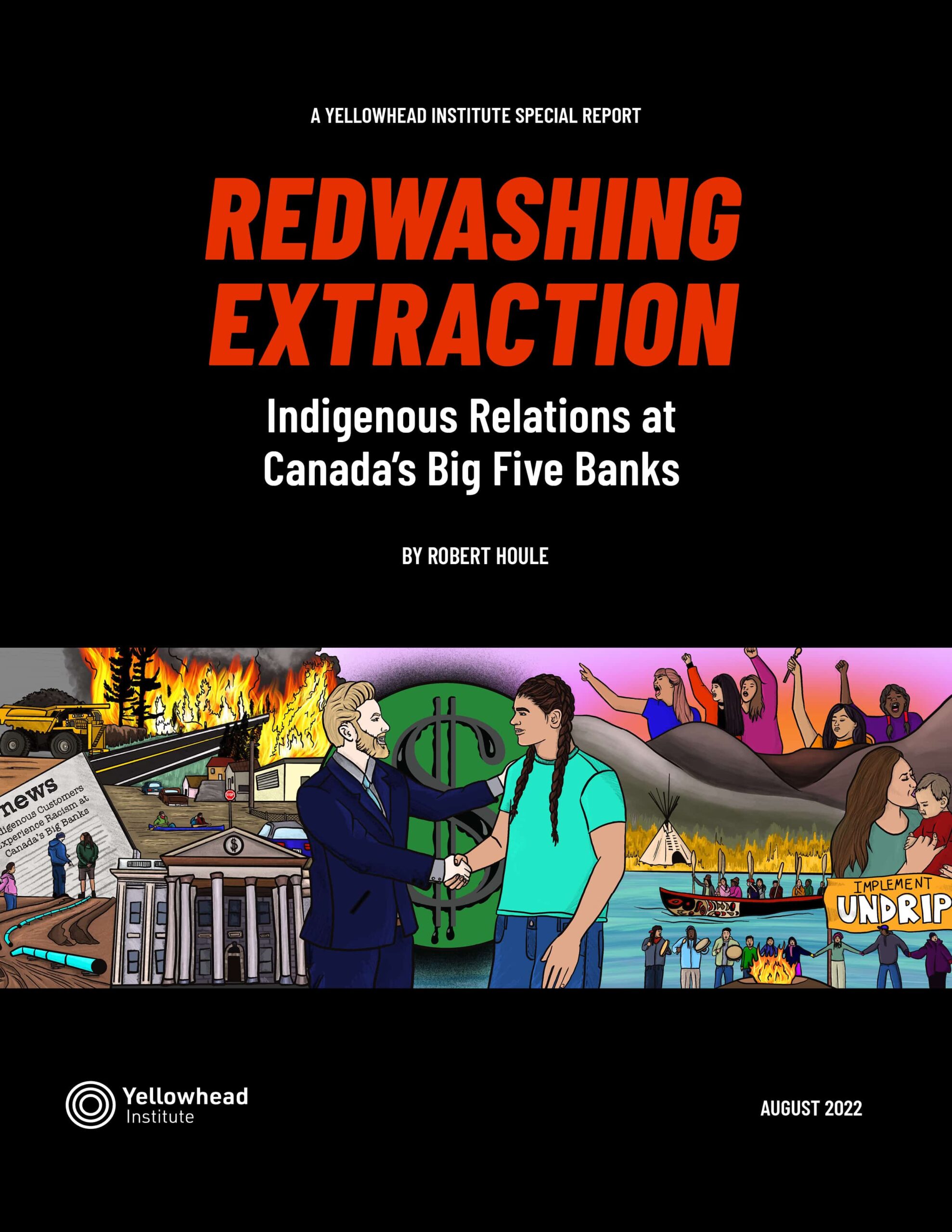

While approaches to consultation and accommodation have been ad hoc, failing to honour these new legal principles has given rise to a fear or culpability among industry. Departing from this context, the research here turns towards those most implicated: banks. How are banks responding to the rise of Indigenous rights? The “Redwashing Extraction” research team analyzed the role that the Royal Bank of Canada, Toronto Dominion, Scotiabank, Bank of Montreal, and the Canadian Imperial Bank of Commerce have played financing resource extraction against the backdrop of their approaches to Indigenous relations more generally.

By taking a snapshot of available data between 2019–2021, we were able to understand how each of Canada’s Big Five Banks has approached Indigenous relations and their interpretation of Indigenous rights. We found that while there are modest examples of progress, bank efforts are typically performative and superficial. Moreover, they tend to mask their inaction behind self-reporting certification processes that validate their limited engagement with communities. Ultimately, we argue that recent legal tools might be the only short-term opportunities to continue holding the financial industry accountable for infringements on rights and title.

KEY QUESTIONS

- How are banks interpreting Indigenous rights in the era of reconciliation?

- Have the Big Five done enough to mitigate the negative impacts experienced by Indigenous people?

The time has come for governments, industry, and financiers to stop continually passing the proverbial buck when it comes to respecting, acknowledging, and upholding Indigenous rights. Indigenous leaders and community members should no longer be appeased with performative gestures, like pledging to fight climate change with the right hand while handing out cash for pipelines with the left, but demand meaningful changes to how projects are proposed, planned, and ultimately funded.

- robert houle